- Delhi / Noida / Mumbai

- +91-8700240946

Sign Up Now and Get Expert Tax Support

At the Heart of Business Compliance

MunshiGiri.com is a New Delhi-based advisory firm helping individuals and businesses with tax, compliance, and registrations.

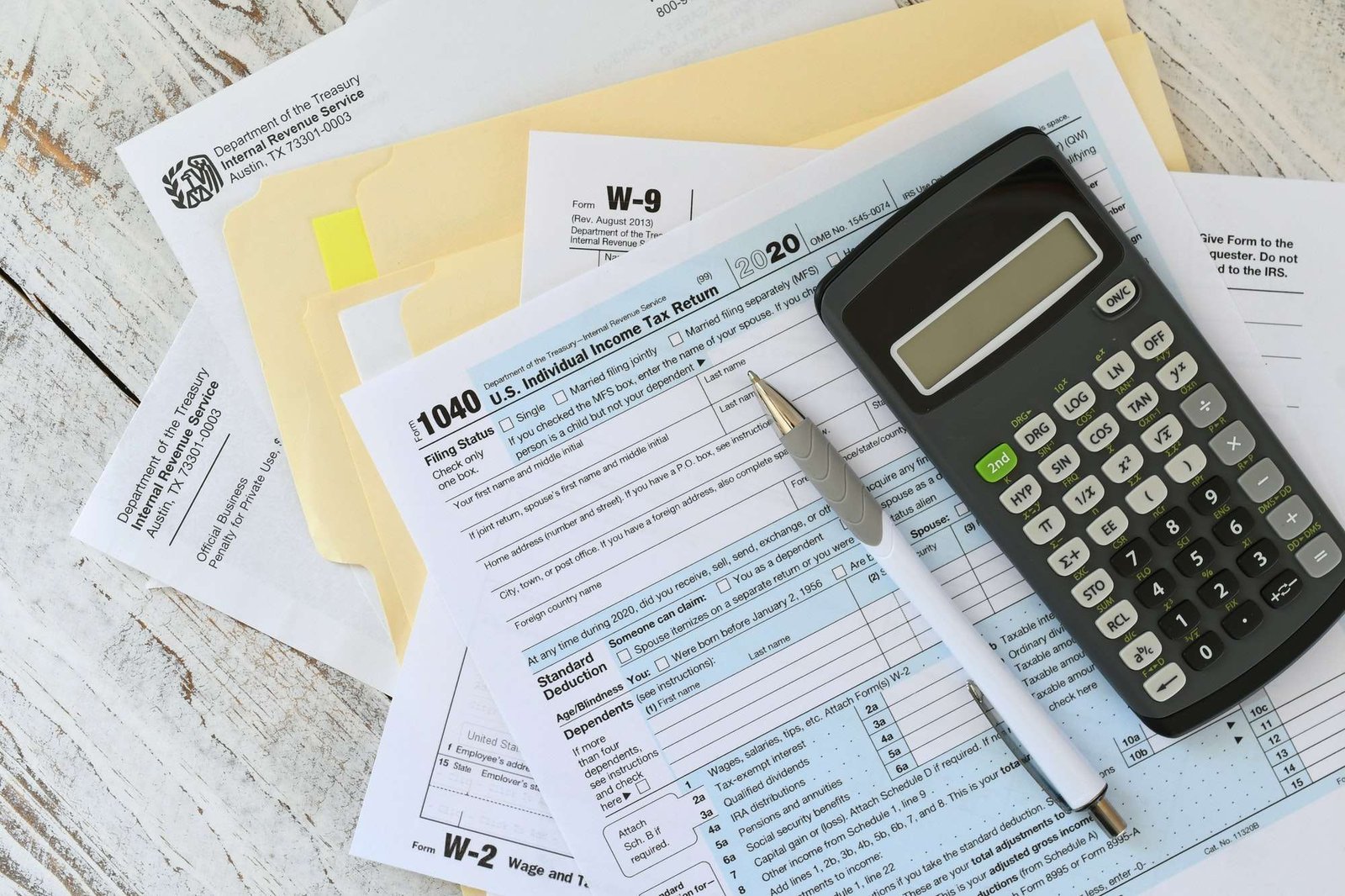

GST & Tax Filing

Business Registration

Accounting & Bookkeeping

Maintain error-free accounts and stay audit-ready always.

Trademark & IP Protection

Secure your brand with trademark and IP registrations.

Expert Tax & Compliance

GST, ITR, compliance and filings done by professionals.

Transparent and Clear

Clear pricing, clear process, and timely work updates.

Complete Business Support

Registration, accounting, trademark and legal services.

Efficient Process

Quick documentation, fast filing, and prompt assistance.

Financial Services Official Updates

Stay updated with the latest announcements, notifications, and official updates from the Department of Financial Services.

- Our Services

Our Most Popular Services

- Daily accounting entries

- Ledger & voucher maintenance

- Bank reconciliation support

- Monthly reporting

- Audit-ready books

- New GST registration

- Monthly/quarterly returns

- Input tax credit matching

- GST notices support

- Late fee guidance

- ITR for all categories

- Tax saving advice

- TDS review support

- Refund tracking

- Notice handling

- Trademark search

- Application filing

- Objection reply support

- Follow-up & tracking

- Brand protection help

- LLP incorporation support

- LLP agreement drafting

- DPIN/DSC assistance

- ROC filing setup

- Compliance guidance

- Pvt Ltd incorporation

- OPC registration

- Partnership registration

- PAN/TAN assistance

- Startup documentation

- Class 3 DSC issuance

- DSC renewal support

- MCA & GST usage

- Quick verification

- Secure digital signing

- Annual ROC filings

- Director KYC (DIR-3)

- Company annual returns

- Minutes & resolutions

- Compliance reminders

Our Official Partners

- Business Support

We’re Here to Help You

Your Trusted Partner for GST, ITR & Business Registrations

- Testimonials

What They Say

"MunshiGiri Team knows their job well and does it even better. They are very professional and efficient where work is concerned."

I am thankful to the entire team of Munshigiri.com for excellent knowledge persistence for accounting to return filing. Everything is done seamlessly!

“I have been doing my GST monthly filing with the help of MunshiGiri. They are the expertise in this field with a great team who are always ready to help me out.”

“I'm very happy about choosing MunshiGiri for my GST filings. They always keep me updated with the work process. The charges are also affordable.”

"Our company registration have been done very professionally with the help of MunshiGiri Team. They also carry out our company compliances very well."

I m not worried about a single due date ! Munshigiri team ensures timeliness in filing returns! Kudos to the Team !

“I have to confess one major thing that MunshiGiri has the best expert team in place. They complete the filings well before the due dates.”

"Amazing work done by MunshiGiri Team. Special Thanks to Adnan Hasan who has incorporated our company. Very professional, efficient and cooperative.!"

- News & Blog

Latest Blog & Articles

Taxation can often feel confusing, time-consuming, and stressful—especially when rules keep changing and deadlines are…

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy. They generate employment,…

Goods and Services Tax (GST) has become one of the most important compliance requirements for…

- Free Quote

Do Not Hesitate To Ask Us Any Questions.

Have a query about GST, ITR, registration, or compliance? Our experts are here to guide you with the right solution.

- Delhi / Noida / Mumbai

- info@munshigiri.com

- +91 87002 40946

- Monday to Friday 8:00 AM to 5:00 PM